8 Easy Facts About 3c Online Ltd Described

Although some consumers do not want the trouble of going into a shop, there are some that choose an extra individual, face-to-face experience - https://www.brownbook.net/business/52640608/3c-online-ltd/. This enables customers to take matters into their very own hands by routing the course of the experience based upon their own desires and needs. Despite having all the choices available, email is thought about a go-to technique of customer service

It also enables others to see their interactions with the firm. Business can get to out to their customers via message messaging before or after any transactions take place - outsource customer support.

6 Easy Facts About 3c Online Ltd Described

This led several business to execute systems online and by phone that response as many concerns or fix as numerous problems as they can without a human presence. In the end, there are client solution issues for which human communication is crucial, developing a competitive advantage. Amazon is an instance of a company that is attempting to automate a large and intricate procedure.

Amazon still offers 24-hour client service by phone, in enhancement to email and live conversation solutions. The majority of effective companies acknowledge the significance of offering outstanding customer support. Considerate and empathetic communication with a trained consumer service rep can indicate the distinction between shedding or retaining a customer. The typical yearly income for a client service representative in 2023, according to Glassdoor Much is anticipated of customer care agents.

What Does 3c Online Ltd Do?

The approximated complete spend for as of 2023 is $42,135 per year, with a typical salary of $39,599. Some of the work assumptions: Customer service representatives have to be available, well-informed, and polite. They need excellent paying attention skills and a determination to talk via a resolution. Training in dispute resolution can be advantageous.

They're likewise really good at problem-solving and being positive. It's important for them to have a level of professionalism and reliability, which indicates that when things get heated up, they can take a go back and not take anything to heart. A few of the methods to supply reliable customer service consist of giving a friendly and cozy experience, paying attention, and empathizing.

Keeping one step successful means remaining to find means to boost and offer an also better consumer experience.

The Basic Principles Of 3c Online Ltd

A strong culture and credibility goes a long means for any type of brand. The culture is the psychology, attitudes, and ideas that influence a brand name experience. The story of your business and how your team participants engage with it is what establishes society and track record. In order to first develop your society, you initially require to define your brand name society.

3c Online Ltd for Dummies

Your clients require to be able to separate you from your rivals Learn More when it comes to values. Next, you require to flaunt it, and that begins with top management.

Motivate staff members to share favorable client experiences and have your workers proactively engaged with your brand's culture. Doing every one of this will assist build a solid culture and reputation. The end outcome will certainly be development for your brand name. Referrals are an effective way to have your clients do your marketing for you.

Getting The 3c Online Ltd To Work

Whether you're looking for a brand-new cars and truck, a physician, or a realtor, you connect to the individuals that you trust. The value of referrals is indisputable. References are a powerful means to obtain your consumers to do the advertising and marketing for you and, with terrific client service, you raise the opportunities that existing clients will refer you to their social circle.

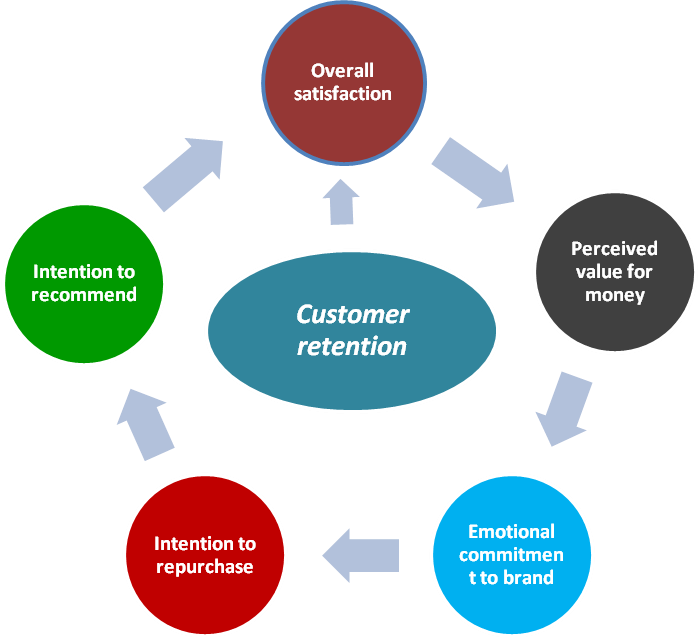

By giving constantly great client solution, you incentivize repeat company and draw new clients in. Upselling is when you supply the customer a high valued option or an add-on to the product they are purchasing.

8 Simple Techniques For 3c Online Ltd

When you concentrate on providing terrific customer solution, it ends up being less complicated to upsell your clients and boost your profits. This is due to the fact that customer support builds count on in between a firm and consumer. If a customer really feels that they have been treated well by your company in the past, they'll likely be more likely to boost their costs with you and check out added solutions you might use.

This is due to the fact that better clients have a tendency to bring about better workers. Positive expert connections assist in happiness for both parties, whereas upset or confused consumers can result in staff member tension and exhaustion. Excellent customer support can be a valuable marketing factor for your service. Besides, if two companies supply a comparable product yet one gives far better customer support than the other, which firm do you believe a lot more customers will choose? Every client intends to be sustained and treated with respect - customer experience.

About 3c Online Ltd

2022 is the specifying year for organizations to understand that offering high-quality items and solutions is no much longer sufficient to win the commitment of potential customers. It is necessary to recognize the reality that today's consumers are ending up being increasingly demanding. When a client involves with a brand name, they anticipate that the company will exceed and beyond to provide the finest client experience that is humanly feasible.